The cryptocurrency landscape is a volatile and ever-evolving arena, a digital frontier where fortunes are made and lost with dizzying speed. At the heart of this ecosystem lies Bitcoin mining, a process as critical as it is energy-intensive. But what happens when the traditional world of accounting standards, specifically the Financial Accounting Standards Board (FASB), casts its gaze upon this decentralized, revolutionary industry? The answer, as with most things crypto, is complex and potentially transformative. The implications of FASB’s decisions on Bitcoin mining businesses, particularly concerning accounting practices, are significant and warrant careful consideration.

For years, companies involved in Bitcoin mining have grappled with the challenge of accurately representing their digital assets on their balance sheets. Under previous accounting guidance, cryptocurrencies like Bitcoin were typically classified as intangible assets, requiring them to be recorded at cost and tested for impairment. This meant that if the market price of Bitcoin fell below its cost basis, the mining company would have to recognize an impairment loss, even if the company believed the price would eventually recover. This created a situation where mining companies could be forced to report losses even while holding appreciating assets, a distortion that didn’t accurately reflect their financial health.

FASB’s recent decision to change the accounting treatment of certain crypto assets, including Bitcoin, aims to address these concerns. The new guidance allows companies to measure these assets at fair value (market price) each reporting period, with changes in fair value recognized in net income. This means that instead of only recognizing losses when the price falls below cost, mining companies will also be able to recognize gains when the price rises. This aligns the accounting treatment more closely with the economic reality of holding a volatile asset like Bitcoin.

However, this new approach isn’t without its challenges. Fair value accounting introduces volatility into a company’s reported earnings, which could make it more difficult for investors to assess the underlying performance of the business. Mining companies will need to carefully manage their communication with investors to explain the impact of these accounting changes on their financial results. Furthermore, the new guidance only applies to certain crypto assets, and it doesn’t address all of the accounting challenges faced by mining companies. For instance, the accounting for energy consumption, depreciation of mining equipment, and other operational costs remains complex and subject to interpretation.

Beyond Bitcoin, the ripple effects of FASB’s decision could extend to other cryptocurrencies, including Ethereum (ETH) and even meme coins like Dogecoin (DOGE), should they meet the criteria for fair value accounting. While Dogecoin’s price is often driven by social media sentiment and Elon Musk’s tweets, its increasing acceptance as a form of payment by some businesses could potentially lead to its inclusion under the updated guidance. The implications for miners of these alternative coins are similar to those for Bitcoin miners: greater transparency but also increased earnings volatility.

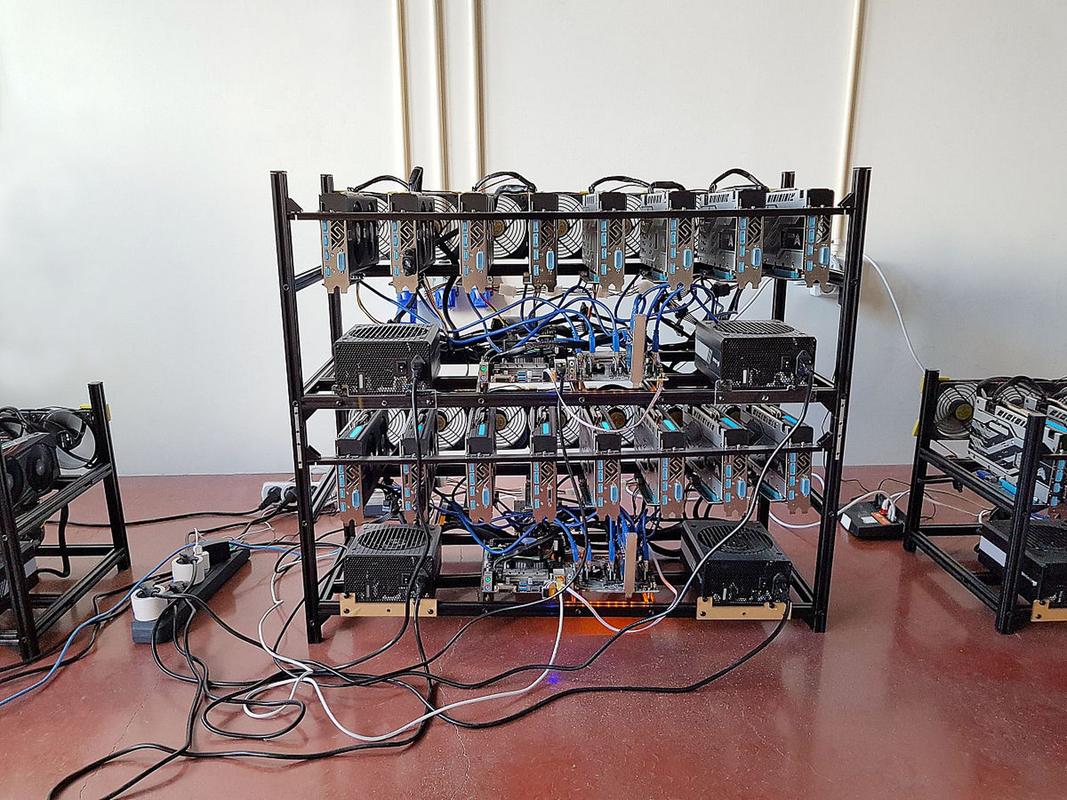

The mining rig, the workhorse of the entire operation, also faces a nuanced accounting treatment. While the crypto holdings might be valued at fair market value, the rig itself, a tangible asset subject to depreciation, continues to be treated under traditional accounting principles. Calculating depreciation, especially considering the rapid technological advancements in mining hardware, requires careful consideration and can significantly impact profitability.

Moreover, the location of the mining operation, often in expansive mining farms strategically located in areas with inexpensive electricity, presents its own accounting complexities. The cost of land, infrastructure, and electricity consumption must be meticulously tracked and accounted for, adding another layer of financial responsibility to the mining business.

For those involved in mining machine hosting, where they provide infrastructure and services to individual miners, the FASB ruling could have indirect impacts. The overall health and profitability of the mining industry, influenced by accounting practices, affects the demand for hosting services. If miners struggle to accurately represent their financial performance due to outdated accounting methods, it could stifle investment and growth in the entire sector, including hosting providers. Conversely, greater transparency and clarity could attract more institutional investment, boosting the demand for hosting and driving innovation in the industry.

Cryptocurrency exchanges, where miners often convert their mined coins into fiat currency, also play a crucial role. The efficiency and liquidity of these exchanges directly impact the profitability of mining. Any regulatory changes or accounting standards that affect the exchanges’ operations could have indirect consequences for mining businesses. A stable and well-regulated exchange environment is essential for miners to effectively manage their risks and maximize their returns.

Ultimately, FASB’s move towards fair value accounting for certain crypto assets represents a significant step towards mainstream acceptance and integration of cryptocurrencies into the traditional financial system. While challenges remain, the increased transparency and accuracy in financial reporting should benefit mining businesses in the long run, attracting more investment and fostering sustainable growth. However, mining businesses need to adapt quickly, understand the nuances of the new accounting rules, and proactively communicate with investors to navigate this evolving landscape successfully. The future of Bitcoin mining, and the broader cryptocurrency ecosystem, depends on it.

Lee

06/12/2025This article delves into the implications of FASB’s new guidelines on Bitcoin mining, exploring how accounting standards could reshape financial practices for miners. It offers nuanced insights into compliance challenges, operational costs, and potential shifts in investment strategies, making it essential reading for industry stakeholders navigating this evolving regulatory landscape.