In the rapidly evolving landscape of digital currency, hosted cryptocurrency mining has emerged as a game-changer, offering a lifeline to those eager to participate in the blockchain revolution without drowning in the technical complexities that accompany it. At its core, hosted mining involves outsourcing the management and operation of mining machines to professional data centers or hosting services, providing miners with a seamless entry into the intricate world of cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG). This model not only optimizes resource utilization but also democratizes access to mining, historically a domain dominated by tech-savvy individuals and sizeable capital stakeholders.

Venturing deeper, the significance of choosing the right mining rig cannot be overstated. Mining rigs, the backbone of any mining operation, come in varied forms from ASICs tailored for Bitcoin’s SHA-256 algorithm to GPUs more adept at Ethereum’s Ethash hashing power. Hosted mining services typically curate an extensive inventory of these rigs, catering to diverse currency algorithms and user expectations. This diversity means that whether you’re chasing the pioneering trails of Bitcoin or the growing ecosystem of Dogecoin, there’s a tailored solution designed for optimal hash rates and energy efficiency.

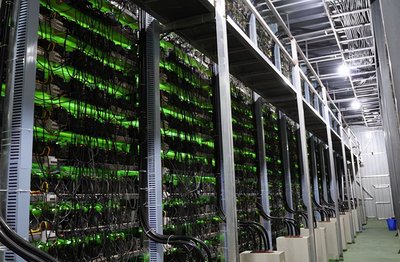

Mining farms, the colossal data centers housing thousands of mining rigs, are the beating heart of hosted mining. These farms leverage economies of scale, advanced cooling systems, and often renewable energy sources to drive down operational costs while maximizing uptime and computational power. For an individual miner, tapping into these farms through hosting services translates to accessing high-efficiency equipment and infrastructure without the burdens of physical maintenance or exorbitant electricity bills. Moreover, such centralized hubs foster an ecosystem where rapid equipment upgrades and scaling become feasible, keeping pace with the volatile demands of cryptocurrency markets.

However, navigating hosted mining isn’t merely about hardware allocation; it’s an intricate dance involving cryptocurrency market dynamics, exchange volatility, and technological advancements. Platforms facilitating hosting often integrate real-time monitoring dashboards, granting miners transparency over their rig’s performance metrics, expected yields, and cryptocurrency price fluctuations. Given the unpredictable nature of digital currencies, where sudden price surges or crashes can impact profitability, these tools empower users to make informed decisions about their mining strategies, whether it involves ramping up hash rates, switching mining pools, or diversifying currency portfolios.

Bitcoin remains the titan in hosted mining domains, commanding most of the hashing power distributed across mining farms globally. The allure of BTC mining lies in its substantial network security and liquidity on exchanges, ensuring that mined coins can be seamlessly converted into fiat or other digital assets. Yet, the influx of alternative cryptocurrencies like Ethereum, with its transition toward proof-of-stake reducing mining in the future, and Dogecoin, renowned for its vibrant community and meme-driven appeal, has fostered diversification. Hosted mining providers are increasingly incorporating multi-currency rigs to cater to miners interested in broadening their exposure, optimizing returns, and hedging against market swings.

Security and regulatory frameworks also shape the hosted mining milieu. With cryptocurrencies inhabiting a somewhat nebulous legal status across jurisdictions, hosting providers often emphasize compliance, transparency, and data integrity. This commitment reassures miners that their investments in mining machines and operational longevity are shielded from arbitrary shutdowns or legal pitfalls. Concurrently, integrating wallet management and direct exchange APIs into hosting platforms streamlines the post-mining process, allowing miners to automate coin transfers, convert earnings, or reinvest in additional rigs without stepping outside the ecosystem.

The rise of hosted mining also pulses in tandem with innovations within exchange platforms. Decentralized exchanges (DEXs) and centralized giants continuously influence miner behaviors, offering diverse trading pairs, staking rewards, or liquidity mining opportunities that can complement traditional mining income. For instance, miners might choose to stake some of their mined ETH on DEXs or leverage DOG tokens earned mining Dogecoin for yield farming, thus augmenting overall profitability beyond straightforward coin accumulation. This symbiotic relationship underscores the importance of holistic understanding among hosted miners—spanning hardware mechanics, market trends, and cross-platform integrations.

Beneath the technical and financial currents lies the human element. Hosted mining effectively lowers the entry barrier, enabling enthusiasts, investors, and even businesses to actively contribute to cryptocurrency networks’ decentralization and security. It democratizes mining power distribution while stimulating innovation in machine design, energy solutions, and blockchain applications. As the crypto universe expands with new coins, protocols, and use cases, hosted mining positions itself not just as a service but as a pivotal enabler of the next digital economy wave, fostering inclusion and sustainability alike.

In conclusion, navigating the domain of hosted cryptocurrency mining is both an exciting and complex journey. For companies specializing in selling and hosting mining machines, success hinges on blending technological excellence with market acumen, ensuring clients receive cutting-edge hardware, responsive hosting environments, and comprehensive support. As the cryptocurrency ecosystem matures, so too will the sophistication and appeal of hosted mining services, tethered inexorably to the fortunes of Bitcoin, Ethereum, Dogecoin, and the evolving array of digital assets shaping our financial future.

Gnosis

02/01/2024This guide on hosted crypto mining brilliantly demystifies setups and risks, weaving tech tips with market tales, but surprisingly glosses over eco-footprints, leaving savvy miners craving deeper insights.